Worried about capital flight from Russia? Don’t be, says Renaissance Capital. Net outflows, the bane of the Russian economy for years, are dropping, and could turn into a (small) net surplus for 2013, given improving prospects for the global and Russian economy.

Worried about capital flight from Russia? Don’t be, says Renaissance Capital. Net outflows, the bane of the Russian economy for years, are dropping, and could turn into a (small) net surplus for 2013, given improving prospects for the global and Russian economy.Worried about capital flight from Russia? Don’t be, says Renaissance Capital. Net outflows, the bane of the Russian economy for years, are dropping, and could turn into a (small) net surplus for 2013, given improving prospects for the global and Russian economy.

Fair enough. But that will still leave Russia far adrift of other emerging markets in terms of attracting foreign money. Investors will want to see radical shifts in the economic plans of the new Putin presidency before they even consider a rethink.

As the FT reported, the central bank on Friday published data showing 2012 net capital outflows amounted to $56.7bn, down from $80.5bn in 2011.

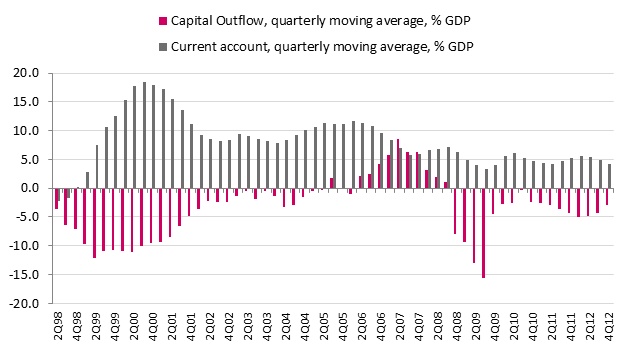

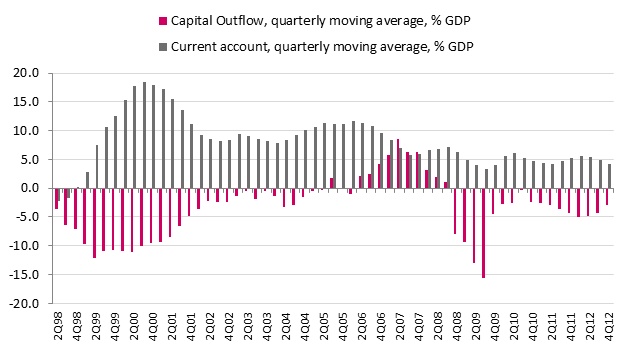

As RenCap economist Ivan Tchakarov writes in a note on Monday, the four-quarter moving average of capital outflows dropped to -2.9 per cent of GDP, down from -4.3 per cent of GDP in Q3 2012 and -4.9 per cent of GDP in Q1 2012 and Q2 2012. This RenCap chart paints the picture:

Tchakarov comments:

As we have argued at nauseam, the issue of capital outflows has been given unduly large weight in 2012. While the 1998 sovereign crisis saw about 10-12% of GDP net capital outflows and the 2008/09 Great Recession was associated with 15% of GDP net outflows, outflows in 2012 reached a maximum of 5% of GDP in 1H12.

We anticipate the positive trend with net outflows from the last 2 quarters in 2012 to become entrenched as the improving global backdrop in 2013 and the dissipating domestic risk premium to lead to small net inflows in the current year.

Barclays is also positive, pointing to recent inflows of foreign investment in Russian domestic bonds: "First estimates by the Bank of Russia (CBR) for Q4 2012 show a significant reduction in net private capital outflows to $9.4bn from $35.0bn in Q4 2011 (these figures include private cross-border flows of both Russian and foreign entities). Growing global interest in local assets supported this trend. However, we believe most of the recent improvement was Russia-specific, generated by a rise in foreign investors’ interest in OFZ bonds.”

The improvement in the overall balance is good from a macroeconomic perspective, partly offsetting the decline in the current account surpluses, which have dropped as imports have risen in recent years and oil export volumes have declined.

However, this isn’t the whole story. As Courtney Weaver wrote in the FT, 2012 capital inflows were boosted by a sharp increase in foreign fund-raising by Russian banks which borrowed heavily and recorded net inflows of $23.6bn for the year. This compares with a $24.2bn outflow in 2011.

Russian non-financial companies and individuals continued to plough money abroad, so that in the non-financial sector the net outflow was $80.4bn, the highest on record and well up on the $56.4bn recorded last year.

To make matters, worse, the biggest outflow in the non-financial sector was in the fourth quarter, undermining hopes that the investment climate is improving now that president Vladimir Putin is safely back in the Kremlin, following his triumph in the spring elections.

Like many aggregates, capital account figures put together apples and oranges, without discriminating much between short- and long-term investments and loans, let alone between very different types of investor.

But the bottom line is that the improvements are, at best, hesistant. That should worry the Kremlin because, without another drastic surge in commodity prices, Russia’s long-running current account surpluses are due to evaporate in two or three years.

At that point, the sometimes obscure arguments about the nature of Russia’s capital flows could become very pressing.

_jpg/250px-ElbeDay1945_(NARA_ww2-121).jpg)